UPDATE 2024/01/04: This post originally appeared on my Civility and Truth Substack newsletter. I’ve moved it to my main site in an effort to collect all of my writing in one place.

After looking at median household income for Maryland counties, I’m now turning my attention to median home values for the same geographies. But before I start, a brief apology for getting this out two days later than my (self-imposed) schedule; I’m switching to a new method for retrieving census data and map geometry, and it took longer than I thought to get the kinks out of my code.

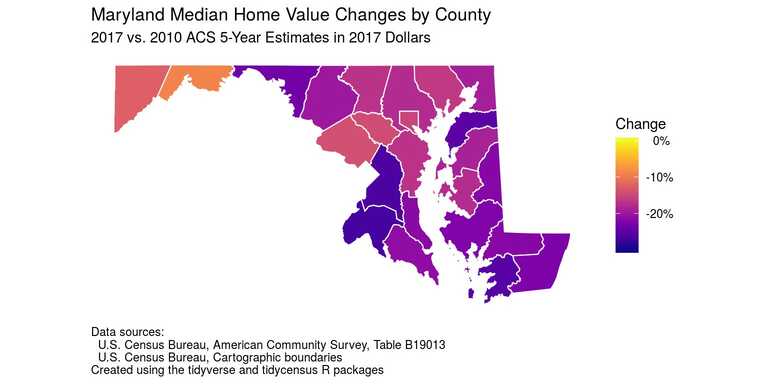

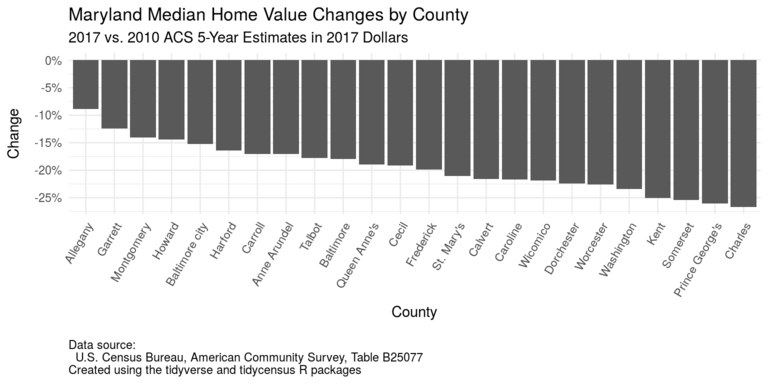

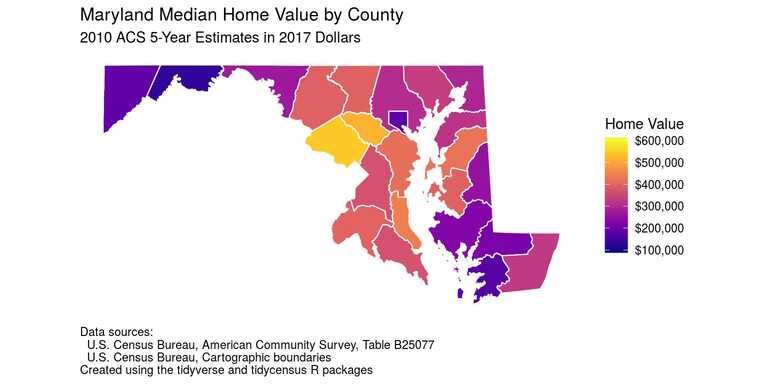

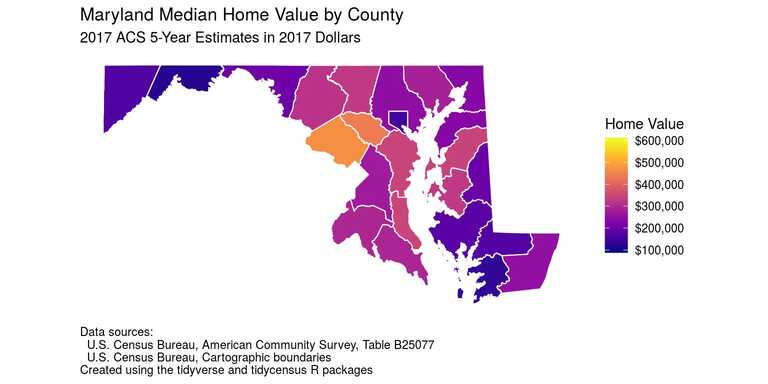

As you can see in the map above, median home values in Maryland have not yet recovered from the Great Recession. As the following bar chart shows, all Maryland counties experienced declines in inflation-adjusted median home values from the 2006–2010 timeframe (used for the 2010 American Community Survey 5-year estimates) to the 2013–2017 timeframe (used for the 2017 ACS 5-year estimates). Allegany and Garrett counties fared the best, followed by Montgomery and Howard counties and Baltimore city, with declines ranging from 8–15%. The worst counties for median home value declines were Prince George’s and Charles counties, with almost 25% declines.

(For the code and data used to generate these and other graphs in this post, see “Maryland median home value trends per county.”)

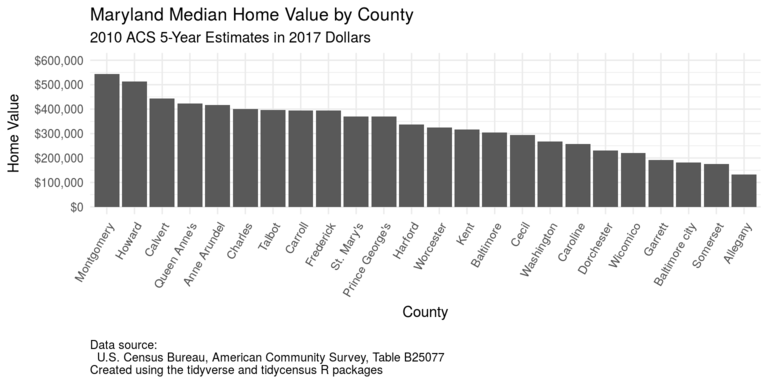

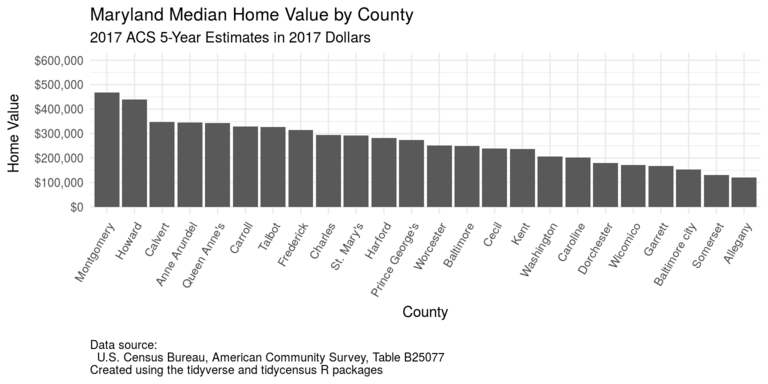

Now, the declines across Maryland are not always directly comparable. For example, as you can see in the two bar charts below, the inflation-adjusted 2010 5-year estimates for median home values in Allegany and Garrett counties and Baltimore city range from just above $100,000 to almost $200,000, so those home values were relatively low to begin with.

On the other hand, the inflation-adjusted 2010 5-year estimates for median home values in Montgomery and Howard counties were over $500,000. A decline of almost 15% from the 2010 estimates to the 2017 estimates therefore represents a decline of about $70,000 to $80,000 in real terms.

The following maps correspond to the bar charts above, and show median home values across Maryland per the 2010 and 2017 ACS 5-year estimates. Again Montgomery and Howard counties stand out for having relatively high median home values, even after the declines between the 2006-2010 and 2013-2017 time frames.

Some concluding remarks: In general we see stable or declining prices as a good thing—no one ever wishes for (say) cars to be more expensive than they are, and the decline in prices for computers and other electronic devices has been universally welcomed.

However homes are simultaneously something you use and something you invest in. Before you buy a home the price is an obstacle. After you buy a home its price is an indicator of your future returns. This complicates the issue of housing affordability in many ways, most notably by pitting the interests of existing homeowners against those of would-be homeowners. I’ll probably have more to say about this in future.